Accessibilty Links

SA FX: Rand: Reduce risk into strength

Executive Summary

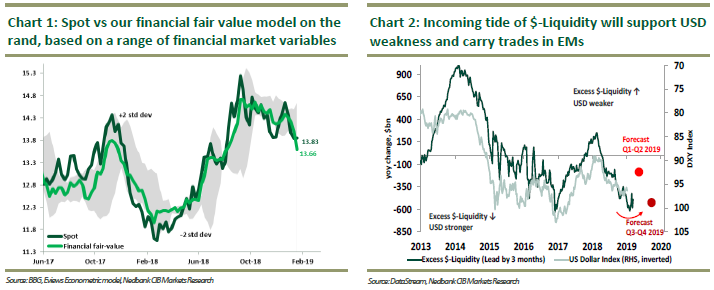

Our view on the currency remains unchanged. Our metrics ($-Liquidity, technicals and fair value models) indicate that we should expect short-term rand strength towards 13.50 and possibly 13.30. We would, however, use such rand strength to reduce exposure – we sell into rand strength. Our year-end target for the rand is between 14.00 and 14.50.

We have seen a largely range-bound rand over the past two weeks, and we thought the currency would have appreciated somewhat against the USD already. However, concerns over global growth and a SARB that turned more dovish than expected on interest rate hikes and inflation prohibited strength. Nevertheless, weaker global growth and a more dovish SARB provides us with more comfort that rand strength may well be temporary and that it should be sold into strength as the 13.50/13.30 range approaches.

Growth concerns were highlighted by the IMF’s latest forecasts, where the global growth forecast for this year was reduced by 20bps to 3.5%. At the same time, the US administration rejected an offer by the Chinese authorities of a preparatory trade discussion, highlighting that the ongoing trade disputes are likely to remain a feature for some time to come.

Locally, the dovish MPC statement last week was, on balance, also rand-negative (see MPC Review of 17 January 2019). For the currency, specifically, an important adjustment by the SARB came via the Quarterly Projection Model (QPM), which now shows just one hike of 25bps over the forecast period, compared to three hikes of 25bps each projected in November 2018 (or four hikes, including the November hike). From a carry-trade perspective, a SARB that hikes less, rather than more, should weigh on the currency if global liquidity recedes again; we expect this to happen later in the year.

We note that valuation-wise, while on a PPP basis the rand appears undervalued relative to other EM currencies, other metrics such as a one-year carry-trade valuation indicate that the rand is overvalued at current levels, relative to other EM currencies (see Chart 7 and Chart 8).

On global liquidity: we expect global financial conditions to ease somewhat (not reverse trend) on an improvement in Global $-Liquidity over the next three months due to an injection of dollars by the US Treasury. We expect that easier global financial conditions and an improvement in Global $-Liquidity stemming from an injection of dollars by the US treasury amid the increasing likelihood that an agreement on the debt ceiling would not be reached before the 1 March 2019 deadline. As a result, excess $-Liquidity is likely to rise, leading to a weaker USD (Chart 2) (for more details, see Global macro insight: Incoming tide of $-Liquidity of 22 January 2019).

From a fundamental view, the rand and other riskier assets are likely to benefit from easier financial conditions and improved risk sentiment, supported by the rise in excess $-Liquidity. However, we believe this improvement in $-Liquidity will not be sustainable and will likely last only for about a quarter. We will use this opportunity to reduce exposure to risk assets. In this scenario, we expect the rand to target R13.50, with the probability of extending to R13.30.

From a technical perspective, we recommend keeping an eye on the USDZAR resistance level of R14.12 and the USDZAR support level of R13.53 (see The correction phase that started in 3Q18 in SA bonds and FX is not over of 23 January 2019).