Accessibilty Links

SA FX Insight: Rand: The anomaly (rand vs. default risk)

Executive Summary

Our rand view remains unchanged – with the rand trading within the 14.00-14.50 range, we are comfortable that local and external risks are being better reflected in the currency. As such, we were selling into rand strength below 14.00, and we would buy into weakness as it approaches 14.50. Although we believe further weakness, at least over the near term, is limited, much would depend on central bank (FOMC, BOJ, SARB) monetary policy guidance at their respective policy meetings and Moody’s review (29 March) of South Africa’s (SA’s) ratings.

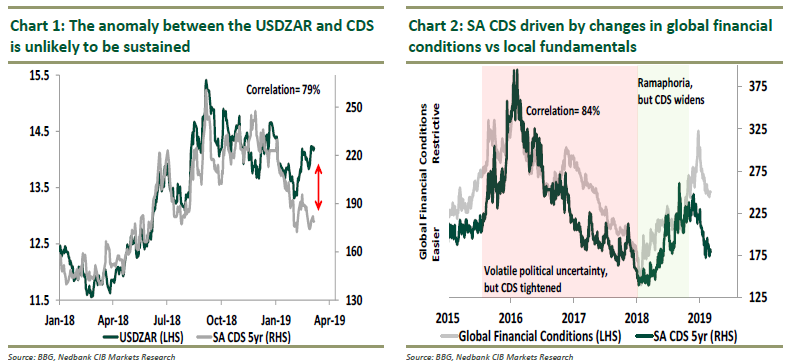

“The Anomaly”: Local financial markets have witnessed an anomaly in recent weeks. Normally, there is a strong positive relationship between the probability of a country defaulting on its foreign currency debt and its exchange rate, i.e., when the probability of a country defaulting rises, as reflected in its sovereign credit default swap (CDS) spread, the value of its currency must drop.

Since February, the relationship between the currency and the CDS spread has broken down. The rand has weakened 8% against the USD, while the sovereign CDS spread has compressed. Intuitively, this does not make sense (Chart 1). Either the market is too bearish on the rand or it is too optimistic on the sovereign CDS spread. Surprisingly, this is not unique to SA; this “anomaly” can be seen in several EMs.

We believe the CDS spread is tightening because of a combination of local and international factors: (1) more appetite for hard-currency (USD) bonds than for domestic-currency (ZAR) bonds, anchored by the market perception that international rating agency Moody’s will not downgrade SA (on 29 March), which is our view too, and (2) easier global financial conditions fuelling demand for riskier assets (Chart 2).

From a currency perspective: We believe this anomaly is not sustainable. Either further weakness in the rand is limited or further compression in the CDS is limited. We believe it is the latter – from current levels, downside for the rand is becoming limited.

That said, we are cognisant that global growth is slowing, inflation remains low and downside risks to financial markets remain intact. As a result, major central bank policy decisions over the coming weeks will be crucial. Action is required by global central banks, not just “jawboning” to support risk appetite going forward; we believe they will largely deliver. It they fail to reflate risk appetite, our view would be negated, and downside risks to the rand would materialise (R14.50-R15.50).

On a multi-month view, our year-end target range for the rand still stands at R14.00-R14.50, as we believe the receding tide of Global $-Liquidity will continue to exert pressure on carry trades as downside risks to financial instability continue to grow.

At this point, we are closely monitoring the R14.50 level. If the USDZAR breaks above this level on a sustained basis, there is a chance it could extend to R15.05. If the R14.50 level holds, we could see the rand retrace to close to R14.30-R14.00. For a technical perspective, please refer to “Technical FX Strategy: How is the long-term picture unfolding? The USD bull remains alive”.