Accessibilty Links

SA FX: Rand reprieve, but downside risks intact

Executive Summary

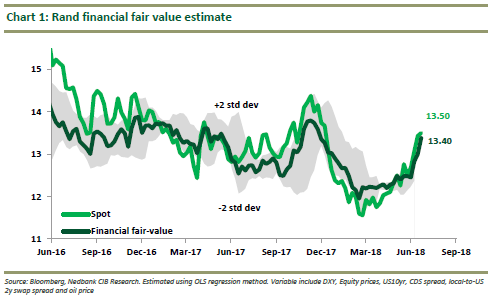

We believe that the rand (and EM currencies more broadly) are set to enter a phase of consolidation and strength after almost three consecutive weeks of rand weakness. However, on a multi-month view we believe that global headwinds are likely to persist. Our tactical target for the rand is 13.30, with a secondary target of 13.10.

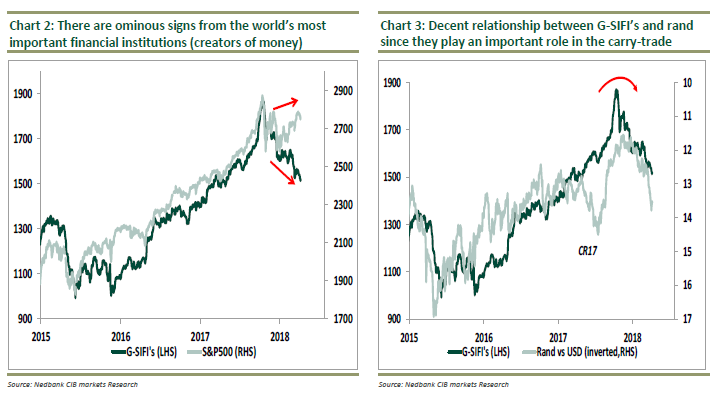

Our tactical expectations for some consolidation and strength in the rand is premised on a number of factors that we are monitoring closely. On the fundamental side, the decline in our global $-Liquidity indicators have lost some momentum to the downside in recent weeks. This is supportive of a period of consolidation in currencies. Furthermore, expectations that the SARB will act by raising rates to counter inflation should the rand weaken too far, is adding additional support in our view (supported by comments by Deputy Governor Kuben Naidoo on Bloomberg TV last week). We believe that technical support is also aiding the rand as the US Dollar Index struggles to hold ground above 95.

In our previous two reports we highlighted that South Africa’s current account for 1Q18 is likely to disappoint, relative to market expectations. The current account balance came in at -4.8% of GDP. The print was wider than Bloomberg consensus of -3.9%. It was also wider than the -2.9% for 4Q17. While it highlights South Africa’s external vulnerability, as base case we believe that the current account will narrow for the rest of 2018. As a result, from a currency perspective, we would not be too concerned that the current widening of South Africa’s external financing requirement is a trend that will persist.

In line with our tactical view, we maintain that the rand will end the year closer to 13.00 than 14.00, and as a result our year-end target remains unchanged at 13.10. However, with that being said we can only revise our forecast should our global $-Liquidity measures move into contractionary state. Currently they have merely lost momentum.

We keep an eye on ominous signs from the global equity market, in particular from the world’s most importantly systemically financial institutions, which may swing the bias towards further weakness in the rand sooner than we anticipate (see next page for detail).

From a technical perspective, we recommend keeping an eye on the $-rand resistance level of R13.52 and support of R13.94 (see our latest Technical Strategy note: “It is time for EM’s to take a breather” of 21 June 2018 for a more detailed technical view on the currency).