Accessibilty Links

SA FX: Rand: Fed put alive and well, but will it be enough?

Executive Summary

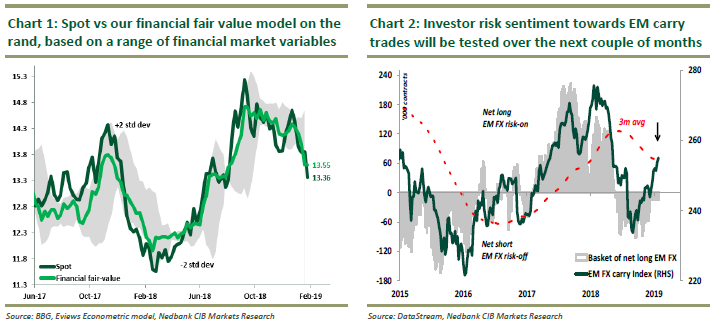

We have reached our tactical targets (R13.50 and R13.30, respectively) on the currency. Our overall view remains unchanged. We expect the improvement in Global $-Liquidity and positive sentiment towards the rand/EM FX to be short-lived (at this point, we expect its impact to fade beyond 1Q19). This is likely to support the rand at current levels, with the possibility of strength towards R13.00. As such, we will use rand strength to reduce exposure – sell rand into rallies, as our year-end target for the rand is R14.00-R14.50.

In terms of our baseline expectations, we now expect only one more interest rate hike from the Fed this year (versus two hikes previously). The Fed has supercharged gains in risk assets (rand, EM FX) after making notable changes in its new policy statement, which was more dovish than the market had expected. While we believe the US economy can endure two rate hikes this year, we believe the fact that financial markets are not coping with tighter monetary conditions has likely forced the Fed to become more dovish, i.e., that the Fed put is alive and well.

From a currency perspective, a more dovish Fed does not change our year-end target for the rand. We believe the Fed alone will not be enough to reverse tighter global financial conditions and Global $-Liquidity for the remainder of the year. As such, we are reluctant to extrapolate current rand strength and change our year-end view on the rand.

We believe the following global macro factors will challenge investor risk appetite and impact the currency negatively: (1) A slowdown in credit creation and the uncertainty surrounding the trade war are likely to weigh on China’s growth, (2) global synchronised growth of the past two years is fading, and (3) global policy uncertainty continues to climb to new highs amid Brexit negotiations, escalating trade wars and growing populist movements.

As a guide to gauge investor sentiment, we will use the three-month moving average (3mma) of the Bloomberg EM FX carry-trade index as well as CFTC investor positioning (net long). The EM FX carry-trade index is currently testing the 3mma, and positioning towards EM FX is net short. A move higher from the 3mma would indicate that investors are not too concerned about the global macro environment. This would support carry trades and bode well for the rand. However, should the EM FX carry-trade index battle to sustain a move higher, it would indicate that investor risk appetite is waning and that the outlook for the global macro environment is deteriorating; this would not bode well for carry trades or the rand (Chart 2).

From an external vulnerability perspective, SA posted a trade surplus of R17.2bn for December (vs R3.3bn in November 2018) amid a sharp drop in imports. We expect the current account deficit to compress to 3.4% of GDP (vs 3.7% of GDP in 2018) amid lacklustre demand from the domestic economy. This is a positive for the rand. From a local calendar perspective, we are heading into in a period of notable risk events in which we can expect volatility in the rand to climb: SOMA (7 February 2019), the SA budget speech (20 February 2019) and Parliament’s vote on land expropriation without compensation (31 March 2019).

From a technical perspective, we recommend keeping an eye on the USDZAR resistance level of R13.60 and the USDZAR support level of R13.30 (see Technical FX Strategy: EMs testing resistance levels of 31 January 2019).